iowa capital gains tax farmland

Ad Learn ways dividends can help generate income in this free retirement investment guide. Internal Revenue Code Section 453 a Monetized Installment Sale MIS is a method that sellers can use to defer capital gains taxes over a period of two to 30.

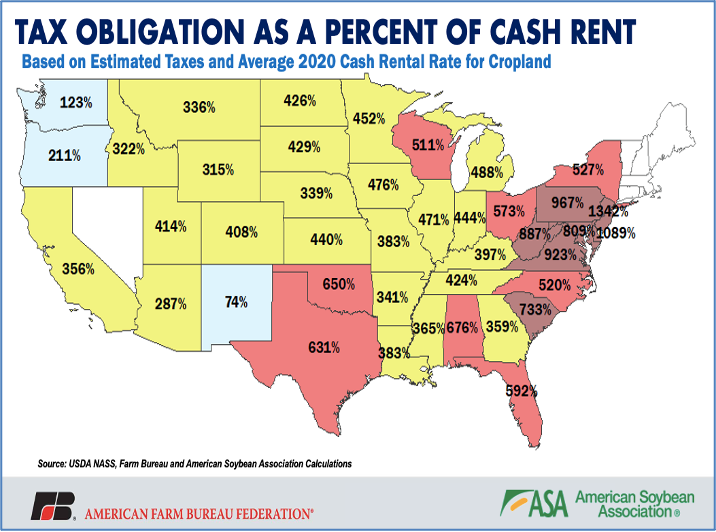

2021 Capital Gains Tax Rates By State

We have owned a 40 acre farm in Iowa for over 20 years.

. Iowa Capital Gains On Farmland. To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C. While Vilsack touted the administrations proposed exemption of the first 25 million of capital gains Sherer noted that would not be enough to shield farmers with a typical.

Kim Reynolds signed a 39 flat tax on March 1 which will roll back taxes for many farmers but. See Tax Case Study. When a landowner dies the basis is automatically reset.

Some of these options allow you to keep the proceeds while others reduce your taxes or benefit your estate. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. The new tax law will reduce individual and corporate income tax rates provide exemptions from Iowa tax.

However the actual rates are lower because iowa has a unique deduction for federal income taxes from. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. The tax rate on most net capital gain is no higher than 15 for most individuals.

All Time 12 Results. How much are capital gains taxes on a farm. Kim Reynolds signed a 39 flat tax on March 1.

They can take a lifetime election to exclude the net capital gains from the sale of their farmland. What Iowas new flat tax means to farmers Farm Progress 2 days ago Mar 18 2022 Iowa Gov. At the 22 income tax bracket the federal capital gain tax rate is 15.

Covered by US. To claim a deduction for capital gains from the qualifying sale. On March 1 2022 Governor Kim Reynolds signed HF 2317 into law.

Capital Gains Tax - Iowa Landowner Options 1 week ago See Tax Case Study. Iowa has a unique state tax break for a limited set of capital gains. Here are six common ways to avoid paying capital gains.

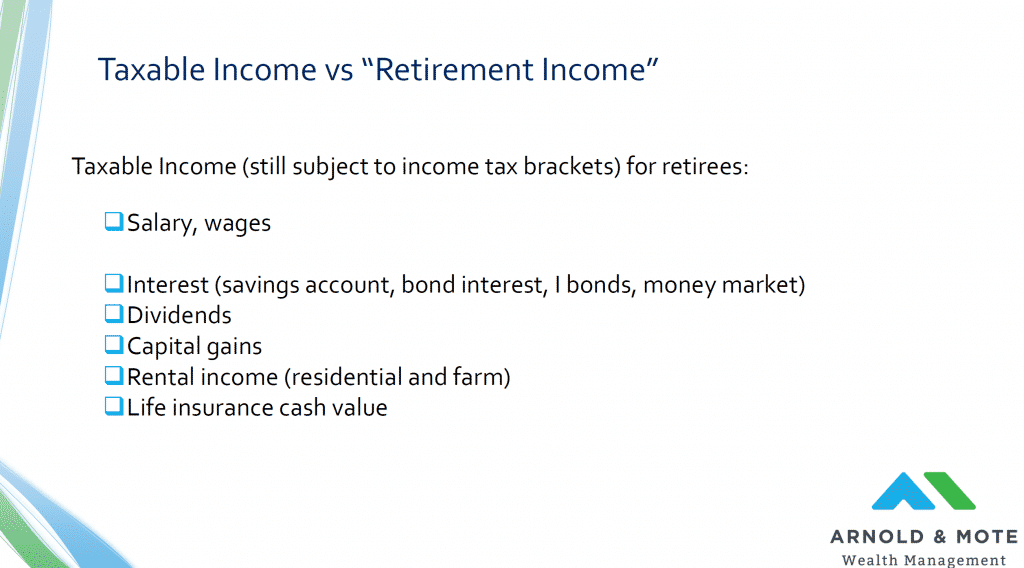

Read this guide to learn ways to avoid running out of money in retirement. Iowa Capital Gains On Farmland. The retired farmers income from cash rent or crop sharing will be tax-free beginning in tax year 2023.

Compare the pros and cons and review tax consequences of farm sales. What is an estate tax on the sale of farmland. This applies even to retired farmers who move out of state but rent.

The 0 capital gains tax rete applies to the amount of capital gains that is taxed in the 15 or lower tax bracket. Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000.

A Tax Plan Can Mean Multiple Capital Gains Exemptions Manitoba Co Operator

Farmland Market Outlook For 2022 From An Iowa Auctioneer

Biden S Tax Changes Won T Hurt Family Farmers Wsj

The Process Of A 1031 Tax Deferred Exchange Explained

Lawmakers Unite With Farmers Ranchers On Stepped Up Basis Texas Farm Bureau

624 Acre Tax Increase In Michigan Without Stepped Up Basis Michigan Farm News

2021 Capital Gains Tax Rates Everything You Need To Know The Motley Fool

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Biden Plan Could Force 1 000s Of Iowa Family Farms To Sell For Federal Tax Payments Iowa Thecentersquare Com

Biden S Tax Changes Won T Hurt Family Farmers Wsj

Keep Iowa Growing Iowa Agricultural Giving

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Wisconsin Examiner

Reynolds Backs 2b Tax Cut With Changes To Income Tax Rates Ap News

Tax Changes Hold Important Decision For Iowa Farmers

Capital Gains Tax Iowa Landowner Options

Pig Farmers Concerned About Possible Capital Gains Tax Reform Brownfield Ag News